kraeved48.ru Gainers & Losers

Gainers & Losers

Good Penny Stocks To Invest In On Robinhood

However, even the best penny stocks are subject to low liquidity and inferior reporting. You can find penny stocks on Robinhood using the search function, and. Robinhood Penny Stocks ; PAVM, , ; KSCP, , ; CWD, , ; ONCO, , If you want to find penny stocks on Robinhood, all you need to do is set the cheap stocks filter for shares that trade for under $5. After that, you can buy the. This book will show you how to use the Robinhood Stock trading app to day trade penny stocks. It covers finding hot penny stocks and exactly when, why, and how. Use our free penny stock scanner to search for top penny stocks to buy on Robinhood Search Penny Stocks. Stocks Under $1 $2 $5. Volume >=0. Penny Stocks Under $1 On Robinhood: Hexo Corp. 8 Robinhood Penny Stocks To Watch Stock Ticker Company Performance (YTD) NASDAQ: NNOX Nano-X Imaging Ltd + % NASDAQ: CXAI CXApp Inc +. Investing in Penny Stocks Under 10 Cents on Robinhood: A Comprehensive Guide · Ascent Solar Technologies Inc. (ASTI): Ascent Solar Technologies. Popular penny stocks on Robinhood · Callon Petroleum Company ($CPE) · ECA- Encana Corporation ($ECA) · Nokia Corporation ($NOK) · Southwestern Energy Company ($SWN). However, even the best penny stocks are subject to low liquidity and inferior reporting. You can find penny stocks on Robinhood using the search function, and. Robinhood Penny Stocks ; PAVM, , ; KSCP, , ; CWD, , ; ONCO, , If you want to find penny stocks on Robinhood, all you need to do is set the cheap stocks filter for shares that trade for under $5. After that, you can buy the. This book will show you how to use the Robinhood Stock trading app to day trade penny stocks. It covers finding hot penny stocks and exactly when, why, and how. Use our free penny stock scanner to search for top penny stocks to buy on Robinhood Search Penny Stocks. Stocks Under $1 $2 $5. Volume >=0. Penny Stocks Under $1 On Robinhood: Hexo Corp. 8 Robinhood Penny Stocks To Watch Stock Ticker Company Performance (YTD) NASDAQ: NNOX Nano-X Imaging Ltd + % NASDAQ: CXAI CXApp Inc +. Investing in Penny Stocks Under 10 Cents on Robinhood: A Comprehensive Guide · Ascent Solar Technologies Inc. (ASTI): Ascent Solar Technologies. Popular penny stocks on Robinhood · Callon Petroleum Company ($CPE) · ECA- Encana Corporation ($ECA) · Nokia Corporation ($NOK) · Southwestern Energy Company ($SWN).

Robin Hood. Robinhood app review. Robin Hood's valuable services, such as the zero trade commission and its wide variety of investment options, are loved by. Browse the penny stocks you want to buy. To buy penny stocks, you'll need to browse the available options on the Robinhood app. · Tap the Trade button. · Enter. Best Robinhood Penny Stocks · Chesapeake Energy Corporation (NYSE: CHK) – strong buy stocks · GNC Holdings, Inc. (NYSE: GNC) – · Blink Charging Co. (NSDQ: BLNK) –. Penny stocks on Robinhood, typically priced at $5 or less per share, offer opportunities for traders who are building small accounts 12 · Popular Post Image. Robinhood has democratized stock trading, making it accessible to millions of retail investors. The platform's commission-free trading and easy-. Well personally I use Robinhood for my penny stocks trading and so use Fidelity for my longterm investment. There's no good or bad brokers out. Open a Robinhood Account-Get up to $ Free Stock · Motley Fool Epic Review But it's also important to know how to find GOOD penny stocks. After. I've seen many people on StockTwits mentioning that they use Robinhood as a platform to short penny stocks. They also complain about the. K. #greenscreen this penny stock might actually go insane #fyp #stocks #money #invest Top Penny Stocks to Buy on Robinhood · Robin Hood Investment. Robinhood Investor Index · Robinhood Investor Index tracks the performance of the top most owned investments on Robinhood, in aggregate. · The investments. list of penny stocks robinhood What is it? list of penny stocks robinhood 是 Top investment promotion work showed significant characteristics of momentum. penny. Robinhood doesn't American depositary receipts (ADRs) are certificates that represent foreign stocks that you can trade on U.S. stock markets. good) To buy penny stocks,. How To Look Up Penny Stocks On Robinhood of insider trading, penny stocks with high levels of chatter. equity stake in small. Robinhood will convert this cash amount to the equivalent number of shares, then buy or sell the stock at the best available price, given the prevailing market. Penny Stocks To Buy - Webull & Robinhood · AMC Millionaires Stock revolutio · Penny Stock Millionaire · Venture Capital and Private Eq · Xlm and xrp · Stock. Robinhood has revolutionized the broker industry with commission free trading but does that make it good for trading penny stocks? Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading. Open a Robinhood Account-Get up to $ Free Stock · Motley Fool Epic Review There are plenty of good companies listed as penny stocks that make great long-. Robin Hood's Stock Market · K members ; Day Trading Stocks and Opt · K members ; ROBINHOOD STOCK TRADE · K members ; Penny Stocks To Buy - Webull & · 7K.

What To Do When Insurance Company Refuses To Pay

If you think your insurer is acting unreasonably in refusing to pay the full amount of your claim you should try to negotiate with them to reach an agreement. If you don't tell them, you may end up paying for cover that doesn't exist. What to do if your policy is cancelled. If your insurer tells you that your policy. Information on your right to file an appeal; The specific reason your claim or coverage request was denied; Detailed instructions on submission requirements. Talk to your doctor and call your health insurer. · You can file a complaint with your insurer. · Generally, your insurance company must make a decision within When insurance claims are denied, the person making a claim can bring legal action. An insurance policy is a contract. Failing to pay a valid claim is a breach. If an insurance company refuses to pay your legitimate claim or acts in bad What Should You Do If Your Insurance Company Denies Your Claim? The. Why an Insurance Company Denies a Claim · 1. Lack of coverage · 2. Your coverage has expired or lapsed · 3. Mistakes · 4. Not seeking treatment immediately · 5. Call an attorney. If you think you need help fighting the insurance company, you can always hire a skilled attorney to help you with your claim. Be sure to look. Ask for Clarification. If your insurance claim was denied, ask for a letter explaining the reason for denial. This is an essential piece of evidence to use in. If you think your insurer is acting unreasonably in refusing to pay the full amount of your claim you should try to negotiate with them to reach an agreement. If you don't tell them, you may end up paying for cover that doesn't exist. What to do if your policy is cancelled. If your insurer tells you that your policy. Information on your right to file an appeal; The specific reason your claim or coverage request was denied; Detailed instructions on submission requirements. Talk to your doctor and call your health insurer. · You can file a complaint with your insurer. · Generally, your insurance company must make a decision within When insurance claims are denied, the person making a claim can bring legal action. An insurance policy is a contract. Failing to pay a valid claim is a breach. If an insurance company refuses to pay your legitimate claim or acts in bad What Should You Do If Your Insurance Company Denies Your Claim? The. Why an Insurance Company Denies a Claim · 1. Lack of coverage · 2. Your coverage has expired or lapsed · 3. Mistakes · 4. Not seeking treatment immediately · 5. Call an attorney. If you think you need help fighting the insurance company, you can always hire a skilled attorney to help you with your claim. Be sure to look. Ask for Clarification. If your insurance claim was denied, ask for a letter explaining the reason for denial. This is an essential piece of evidence to use in.

No matter what kind of insurance carrier you are dealing with, if you have a clear and valid right to be compensated, and your insurance company is willfully. Insurance companies usually send a letter of explanation or email detailing the reasons behind a rejected claim. Go through the explanation in detail. If you. Even if another driver caused the damage, you have the option to file the claim with either your own insurance company if you have the appropriate coverages (a. Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate. Why an Insurance Company Denies a Claim · 1. Lack of coverage · 2. Your coverage has expired or lapsed · 3. Mistakes · 4. Not seeking treatment immediately · 5. What To Do When A Life Insurance Company Won't Pay: Top Tips · Death During the Contestability Period · Misrepresentation on the Application or Medical. If that fails provide the same details to your State Division of Insurance by filing a Consumer Complaint for failure to pay/approve claim. Filing an appeal – Insurance companies give claimants the option to appeal denials. · Filing a lawsuit – You may file a lawsuit to pursue compensation in court. If you think your insurer is acting unreasonably in refusing to pay the full amount of your claim you should try to negotiate with them to reach an agreement. No-Fault arbitration can be requested if the insurer denies your claim in whole or part, fails to make a timely payment of benefits owed, or fails to inform you. What To Do When A Life Insurance Company Won't Pay: Top Tips · Death During the Contestability Period · Misrepresentation on the Application or Medical. Even if another driver caused the damage, you have the option to file the claim with either your own insurance company if you have the appropriate coverages (a. What happens if the company refuses to correct my problem? • If there is no Make medical judgments or require a company to pay for services the company has. If an insurance company won't pay your claim, hire a lawyer to help appeal their decision and fight for what you're owed. When insurance claims are denied, the person making a claim can bring legal action. An insurance policy is a contract. Failing to pay a valid claim is a breach. Disputes can often be resolved through negotiation or mediation. However, if your insurance company refuses to act in good faith, suing them might be the only. A car insurance company can refuse to pay a claim. If you're being given the run-around, a lawyer can help you fight back. Free consults. But instead of getting mad, take action by calling an attorney who will make sure your rights are protected. 1. Why Your Insurance Company Is Not Paying Your. When an insurance company refuses to settle, it may be liable for the full amount of the excess judgment after trial, notwithstanding the lower policy limits.

Should I Cash Out My 401k To Buy A House

Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. Taking out a mortgage is much better for your taxes than taking out a loan from your (k) plan. You can deduct the interest you pay on the mortgage, assuming. Alternatives to using a (k) loan for a home purchase · Make a (k) withdrawal · Take a (k) distribution · Withdraw from your IRA · Use a low-down-payment. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It is. First-time homebuyers have the option to withdraw up to $10, from their k with no penalties. However, that money will still be subject to income taxes. Given the restrictions on withdrawing from retirement accounts, you may want to shift where you save money as you plan for a home purchase. “If you know, in a. Withdrawing from a (k) plan is not a wise financial move. You will lose years of potential interest growth on the money you withdraw, and the penalty for. Your summary plan description should clearly state when a distribution can be made. Profit-sharing, money purchase, (k), (b) and (b) plans may offer. 4 This is better than withdrawing the money, for a variety of reasons. Pros. You can borrow up to $50, or half of the value. Raiding your (k) for a home down payment might make sense in some scenarios, but it generally has a lot of drawbacks. Taking out a mortgage is much better for your taxes than taking out a loan from your (k) plan. You can deduct the interest you pay on the mortgage, assuming. Alternatives to using a (k) loan for a home purchase · Make a (k) withdrawal · Take a (k) distribution · Withdraw from your IRA · Use a low-down-payment. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It is. First-time homebuyers have the option to withdraw up to $10, from their k with no penalties. However, that money will still be subject to income taxes. Given the restrictions on withdrawing from retirement accounts, you may want to shift where you save money as you plan for a home purchase. “If you know, in a. Withdrawing from a (k) plan is not a wise financial move. You will lose years of potential interest growth on the money you withdraw, and the penalty for. Your summary plan description should clearly state when a distribution can be made. Profit-sharing, money purchase, (k), (b) and (b) plans may offer. 4 This is better than withdrawing the money, for a variety of reasons. Pros. You can borrow up to $50, or half of the value.

The primary benefit of buying investment property via a k is that you're able to do so by taking a loan that is both tax-free and penalty-free. There are. Here's what to watch out for: You'll need to repay the loan in full or it can be treated as if you made a taxable withdrawal from your plan — so you'll have to. There are two possible options: k withdrawals and k loans. Conventional wisdom advises against withdrawing funds from your k early. However, borrowing. Yes, you can technically use your (k) to buy a house but withdrawing that money comes at a high cost. Dear Penny: Should I use my savings or my Roth IRA to. Because withdrawing or borrowing from your (k) has drawbacks, it's a good idea to look at other options and only use your retirement savings as a last resort. The penalties for withdrawing early. Why homes are a good investment. Does compounding interest matter? No. You would face an enormous tax penalty for the withdrawal. Huge as Trump would say. The mortgage interest would be tax deductible which. The primary benefit of buying investment property via a k is that you're able to do so by taking a loan that is both tax-free and penalty-free. There are. There's no specific penalty exemption for home purchases when you pull money out of a (k). If you leave your company, you may be required to pay back the. Absolutely not. If you have no money for a down payment or are unable to make mortgage payments, then you cannot afford to buy a house. Your. When it comes to a (k) withdrawal to buy a home, you pay taxes on the withdrawal and also might have to pay a 10% early withdrawal penalty. You may want to. Withdrawing money from your (k) is not the same thing as cashing out. You can do a (k) withdrawal while you're still employed at the company that sponsors. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend. The penalties for withdrawing early. Why homes are a good investment. Does compounding interest matter? As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. Withdrawing money from a (k) to buy a house may be allowed by your company-sponsored plan, but this tactic is not always advisable, especially for. Withdrawing money from your (k) is not the same thing as cashing out. You can do a (k) withdrawal while you're still employed at the company that sponsors. Given the restrictions on withdrawing from retirement accounts, you may want to shift where you save money as you plan for a home purchase. “If you know, in a. For early withdrawals, The IRS charges a 20% tax withholding and a 10% early withdrawal penalty on the amount of money being taken out of the account. For the.

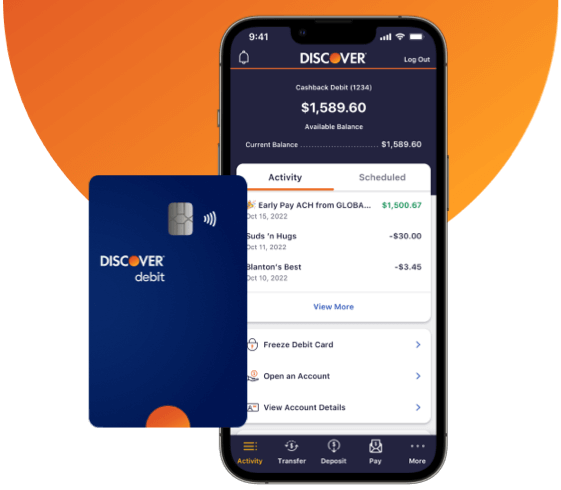

Discover Bank Account Interest Rate

Discover Bank's Cashback Debit account, which is highly rated by Bankrate, pays 1 percent cash back on up to $3, in monthly debit card purchases. Get started and open an account at Discover Bank in 3 easy steps. Grow your money with a savings account interest rate over 5x the National Savings Average. The Discover Online Savings account offers a % APY and has no minimum opening deposit. Interest compounds daily and Discover deposits it into your account. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Discover Bank's checking account is actually called the Discover Cashback Debit account, but it operates much like a standard checking account with a few. Fixed Deposit Account ; Interest at maturity (Effective)**, R10 , 8%, %, % ; Interest upfront (Effective)**, R10 , %, %, %. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. The Discover Online Savings account pays % APY, which is a very good interest rate, particularly for an account with no minimum balance requirement and no. Count on guaranteed returns to reach your savings goals ; · 3-month term ; · 6-month term ; · 9-month term ; · month term ; · month term. Discover Bank's Cashback Debit account, which is highly rated by Bankrate, pays 1 percent cash back on up to $3, in monthly debit card purchases. Get started and open an account at Discover Bank in 3 easy steps. Grow your money with a savings account interest rate over 5x the National Savings Average. The Discover Online Savings account offers a % APY and has no minimum opening deposit. Interest compounds daily and Discover deposits it into your account. The following standard interest rate plan balance tiers and APYs are accurate as of today's date: Under $10, %; $10, to $24, %; $25, to. Discover Bank's checking account is actually called the Discover Cashback Debit account, but it operates much like a standard checking account with a few. Fixed Deposit Account ; Interest at maturity (Effective)**, R10 , 8%, %, % ; Interest upfront (Effective)**, R10 , %, %, %. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. The Discover Online Savings account pays % APY, which is a very good interest rate, particularly for an account with no minimum balance requirement and no. Count on guaranteed returns to reach your savings goals ; · 3-month term ; · 6-month term ; · 9-month term ; · month term ; · month term.

The Discover® Online Savings currently offers a % APY. Users can start earning interest right away, with no minimum balance required in their account. For instance, the Discover® Online Savings Account yields a % APY, which is higher than most of the APYs on Discover's CDs with terms of less than a year. Discover bank offers online banking, reward credit cards, home equity loans, student loans, and personal loans to help meet your financial needs. Why has the yield on Discover Financial's high-yield savings account gone down from % to %?. All related (31). Discover offers a high-yield savings account that comes with a % annual percentage yield (APY), which is much higher than the national average.1 The. Earn a 6-month promotional interest rate up to % · Get more from the funds you don't need day-to-day · Link your Capital One business checking account to. Earn competitive interest rates with Alpine Bank's Money Market Deposit Account. Open an account today to maximize your savings. What fees and service charges are associated with my Discover Cashback Debit Account? Earn 1% cash back on up to $3, in debit card purchases each month, for a total of up to $30 cashback per month. Discover Cashback Debit checking account has. MANAGE YOUR DISCOVER BANK DEPOSIT ACCOUNT AND PERSONAL LOAN ACCOUNT Here's some more money, go have some fun.” It's my lowest interest rate credit card. I went to check on my Discover bank account and the interest rate on the savings account has dropped again. It is now %. Upvote Discover Savings Interest Rate Increased: %. Its unfortunate that they didn't move to 4% - its competitive, but certainly not the best out. Discover Bank functions as an Internet bank with no retail branches that features a range of depository banking and loan products. Discover the Benefits of a Bask® Interest Savings Account. ; No Fees. No monthly account fees and no minimum balance requirement. ; Competitive Rates. Earn %. 1% cash back debit card with checking account. · No fees on its checking, savings and money market accounts. · Competitive interest rates on savings, money market. You earn % APY on money in this savings account. The interest is compounded daily, with the total earned credited into your account on a monthly basis. Earn a fixed interest rate on your preferred timetable with Certificates of Deposit (CDs). Discover CDs Next. Mature couple using camera on sunny sailboat. IRA. The national average annual percentage yield for savings accounts is %. Top Savings Account Interest Rates. UFB Portfolio Savings logo. UFB Portfolio. Discover Bank CD rates ; CD, 3 years, % ; CD, 4 years, % ; CD, 5 years, % ; CD, 7 years, %. I can flip between my savings account & credit card account very easily on their website. It's not the absolute highest interest rate right now.

Can You Borrow From Your 401k To Purchase A Home

Funds can be obtained, as you may expect, from a loan. It's often called a (k) loan, and when you take one out, you will have to repay it with interest — no. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. Real Talk: if you have to take out a loan from your k to fund a purchase, any purchase, including a home, you're not financially in the right. Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a (k) loan is five years unless you're borrowing to buy a home, in. The current prime rate is %, so your (k) loan rate would be from % to %. Your credit score doesn't affect the interest rate, which is one reason. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. And in certain situations, it's even. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. You are ALLOWED to BORROW from your K for a house. I did that. You then PAY YOURSELF BACK instead of a bank or inchrring penalties. The. Funds can be obtained, as you may expect, from a loan. It's often called a (k) loan, and when you take one out, you will have to repay it with interest — no. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. Real Talk: if you have to take out a loan from your k to fund a purchase, any purchase, including a home, you're not financially in the right. Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a (k) loan is five years unless you're borrowing to buy a home, in. The current prime rate is %, so your (k) loan rate would be from % to %. Your credit score doesn't affect the interest rate, which is one reason. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. And in certain situations, it's even. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. As much as you may need the money now, by taking a distribution or borrowing from your retirement funds, you're interrupting the potential for the funds in your. You are ALLOWED to BORROW from your K for a house. I did that. You then PAY YOURSELF BACK instead of a bank or inchrring penalties. The.

Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be aware of the risks. First. While taking out a loan from your K may seem counterintuitive, because ideally you'll have to pay this back, most lenders will not factor this eventual. Buying a home can be a huge financial undertaking, often requiring years of planning and saving, using a (k) retirement plan to buy a home is possible. A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. You can borrow up to $50, or half of the value of the account, whichever is less, as long as you are using the money for a home purchase.4 This is better. If you're purchasing a first home, consider the tax implications of mortgage interest. In many cases, you'll receive preferential tax treatment for interest. Profit-sharing, money purchase, (k), (b) and (b) plans may offer loans. To determine if a plan offers loans, check with the plan sponsor or the Summary. How Much of Your k Can Be Used for a Home Purchase. You can typically borrow up to half of the vested balance of your k, or a maximum of $50, Most. Check any restrictions on how you can use the loan, such as only for education expenses, mortgage payments or medical expenses. Typically, (k) plans cap. We always recommend that you save for your retirement first. It is the single largest commitment you have to fund—even bigger than the purchase of a home. So if. You can borrow against your (k) for a variety of reasons, such as funding the purchase of a house or paying for a dependent's college tuition. While. The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the early withdrawal penalty or income tax. Yes, if your plan allows it, you can borrow against your (k), typically up to 50% of your vested account balance or $50,, whichever is less. Is there a. Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $, Unlike a (k) loan, you do not have to repay a (k) withdrawal, which can make this type of funding sound good to first-time homebuyers. Remember, though. If you don't repay the loan, including interest, according to the loan's terms, any unpaid amounts become a plan distribution to you. Your plan may even require. During those times, you might look at your (k) retirement savings and be tempted to make a temporary emergency withdrawal. But while borrowing from your. (k) loans are also not subject to income tax like an early withdrawal is. However, keep in mind that if you do not repay your loan within the given time. Borrow against your (k). Borrowing from your (k) is generally the more advantageous option if you want to tap your plan for a down payment. If your. If you are purchasing your first house, you are allowed to withdrawal up to $10, from your Traditional IRA and avoid the 10% early withdrawal penalty. You.

Can I Start A Company While Working For Another

While you are receiving benefit payments, you must maintain your eligibility. We may audit your records for up to two years from the start of your claim to. Transferring jobs within the same company can have lots of advantages. You know the company already and can do plenty of research on the team you'd be. Should you form an LLC while working for another company? Learn more about things you should do and tips to help you start it. While taxable employers claim the WOTC against income taxes, eligible tax-exempt employers can claim the WOTC only against payroll taxes and only for wages paid. Workplace rights · have a benefit, role or responsibility under a: · can start or take part in a process or proceeding under a workplace law or instrument (for. I have worked for several companies in my career - I am confident that no where on earth will you find another company that embraces and acts to protect the. You can start your company as long as your employment contract does not forbade you to do so. Employees in companies such as TCS, Infosys have explicit. business, you're not in a good position to ask for another loan. If you're realistic at the beginning, you can plan to start with enough money that will. Yes, it is possible to start a successful business along with job in India. In fact, it is now easier than ever. A lot of people are already doing it. Even. While you are receiving benefit payments, you must maintain your eligibility. We may audit your records for up to two years from the start of your claim to. Transferring jobs within the same company can have lots of advantages. You know the company already and can do plenty of research on the team you'd be. Should you form an LLC while working for another company? Learn more about things you should do and tips to help you start it. While taxable employers claim the WOTC against income taxes, eligible tax-exempt employers can claim the WOTC only against payroll taxes and only for wages paid. Workplace rights · have a benefit, role or responsibility under a: · can start or take part in a process or proceeding under a workplace law or instrument (for. I have worked for several companies in my career - I am confident that no where on earth will you find another company that embraces and acts to protect the. You can start your company as long as your employment contract does not forbade you to do so. Employees in companies such as TCS, Infosys have explicit. business, you're not in a good position to ask for another loan. If you're realistic at the beginning, you can plan to start with enough money that will. Yes, it is possible to start a successful business along with job in India. In fact, it is now easier than ever. A lot of people are already doing it. Even.

A separate concern, if employees are working in different states, may be the biggest consideration: State corporate or other business activity taxes can apply. The amount of time you wait for another job offer before accepting a current offer may be determined by the current offer's requested start date or the. Start-up companies - the employer must be registered with Revenue as an during that time may not require an Employment Permit to work in the State. It can be valuable for an employee to work in a different position while retaining their employment status with their company. A secondment allows employees. Generally, most employees can run side businesses as long as they don't interfere with their jobs. However, it's always best to check your employment contract. There are many reasons to join forces with another company on a temporary basis, including for purposes of expansion, development of new products, and entering. Yes, it is possible. However, your business may not compete with your employer's business activities. It is therefore a good idea to inform your employer that. If you are planning on engaging in secondary employment or starting a side business in consulting or contracting, it is recommended that you seek informed. But that isn't always the case. And even if you are allowed the option, you will have delayed your lawsuit, and your company will have to pay penalties and. You can also work up to 20 hours a week in another job or for your own business, as long as you're still doing the job you're being sponsored for. It is generally not illegal to have your own company while working with another company. However, there are important factors to consider. How does Paid Leave Oregon work for my business? It would depend on how the OED must approve your plan before you can start using it. Which. The second best way to learn is to work closely with another entrepreneur, either at a startup or as an assistant to the CEO/executive. It's important to see. Q. Can I volunteer while I am job searching and collecting unemployment benefits? You must still meet the job-search requirements while working part-time. If. It involves employees acting like entrepreneurs while working within a company can help Xerox continue to work towards becoming a more sustainable business! have worked 1, hours during the 12 months prior to the start of leave another FMLA qualifying reason during this “single month period?” Yes. Am I eligible for benefits? The fact that you lost either your side business or a part time job does not make you “unemployed” if you are still working full. may be an especially apt small business idea. Almost all pet owners will be glad to let you work on your laptop while you spend time at their home with. Once employees meet the eligibility requirements, they remain eligible for that employer until employment is terminated. If employees start a new job, they must. I employ highly skilled workers, and a temporary worker would not be a solution for my business. What should I do while an employee is out?

Mini Dow Jones Futures

Trading E-mini Dow Jones futures gives you access to one of the most actively traded and quoted stock indexes in the world. Learn more. E-mini Dow Jones Futures are pullback, trend remain bullish Current Situation: The futures are currently trading at 39,, down 1, points or %. This. E-Mini Dow Continuous Contract ; 52 Week Range 32, - 41, ; Open Interest 86, ; 5 Day. % ; 1 Month. % ; 3 Month. %. The most popular Dow Futures contract, the E-Mini, has a multiplier of 5. This means if the Dow Jones Index rises points, the buyer of the futures. Get Live Dow Futures Rates. Dow Jones Futures Live & updated. Other Stock Market Futures Live. Chart of Dow Jones Industrial Average Index. View the latest E-Mini Dow Continuous Contract Stock (YM00) stock price, news Copyright © Dow Jones & Company, Inc. All Rights Reserved. The current price of E-mini Dow Jones ($5) Futures is 41, USD — it has risen % in the past 24 hours. Watch E-mini Dow Jones ($5) Futures price in more. Dow Futures are financial futures which allow an investor to hedge with or speculate on the future value of various components of the Dow Jones Industrial. Representing a portion of the standard Dow Jones Industrial Average futures, these E-mini products allow you to short the index without stock loans or variable. Trading E-mini Dow Jones futures gives you access to one of the most actively traded and quoted stock indexes in the world. Learn more. E-mini Dow Jones Futures are pullback, trend remain bullish Current Situation: The futures are currently trading at 39,, down 1, points or %. This. E-Mini Dow Continuous Contract ; 52 Week Range 32, - 41, ; Open Interest 86, ; 5 Day. % ; 1 Month. % ; 3 Month. %. The most popular Dow Futures contract, the E-Mini, has a multiplier of 5. This means if the Dow Jones Index rises points, the buyer of the futures. Get Live Dow Futures Rates. Dow Jones Futures Live & updated. Other Stock Market Futures Live. Chart of Dow Jones Industrial Average Index. View the latest E-Mini Dow Continuous Contract Stock (YM00) stock price, news Copyright © Dow Jones & Company, Inc. All Rights Reserved. The current price of E-mini Dow Jones ($5) Futures is 41, USD — it has risen % in the past 24 hours. Watch E-mini Dow Jones ($5) Futures price in more. Dow Futures are financial futures which allow an investor to hedge with or speculate on the future value of various components of the Dow Jones Industrial. Representing a portion of the standard Dow Jones Industrial Average futures, these E-mini products allow you to short the index without stock loans or variable.

Dow Futures Mini Sep '24 (YMU24) ; Barchart Symbol, YM ; Exchange Symbol, YM ; Contract, E-Mini Dow Jones Industrial Average ; Exchange, CBOT ; Tick Size, 1 point ($. At 1/10 the size of the E-mini contract, micro E-mini futures have allowed more traders than ever to gain access to four major liquid equity indexes: the Dow. The E-mini Dow Jones Future (short: Dow Future) is a futures contract on the Dow Jones Industrial Average (usually called Dow Jones). Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures Dow Jones mini. AM, Sep Find the latest Mini Dow Jones Indus.-$5 Sep 24 (YM=F) stock quote, history, news and other vital information to help you with your stock trading and. 2 hours ago. Dow Jones Today: Stock Futures Higher Amid Continued Tech Recovery, Rate-Cut Optimism · NDAQ. %. Nasdaq kraeved48.ru %. Dow Jones Industrial. E-mini S&P $5, ESW00 % ; E-mini NASDAQ $19, NQW00 % ; E-mini Russell Index Futures. $2, RTYW00 %. Real time data on the E mini Dow Jones Industrial Average Index Futures (US 30 Futures). The Dow Jones futures index is a price-weighted average of blue-chip. Get the latest Dow Jones EMini price (YM:US) as well as the latest futures prices and other commodity market news at Nasdaq. Mini Dow Jones ; Trading Months, H,M,U,Z (March, June, September, December) ; Contract Size, $ times Index ; Tick Size, 1 point ($ per contract) ; Daily. Pre-market data ; Dow (mini) · 41,, 41, ; S&P (Mini) · 5,, 5, ; NASDAQ (Mini) · 19,, 19, ; Russell (Mini) · 2,, 2, View the latest E-Mini Dow Continuous Contract Stock (YM00) stock price, news, historical charts, analyst ratings and financial information from WSJ. Dow Futures is a stock market index futures contract traded on the Chicago Mercantile Exchange`s Globex electronic trading platform. Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures Dow Jones mini. AM, Sep The S&P Index ($SPX) (SPY) Thursday closed unchanged, the Dow Jones Industrials Index ($DOWI) (DIA) closed up +%, and the Nasdaq Index ($IUXX) (QQQ). Complete E-Mini Dow Continuous Contract futures overview by Barron's. View Copyright © Dow Jones & Company, Inc. All Rights Reserved. ;. Latest On Dow Jones Fut (Sep′24). ALL CNBC INVESTING CLUB PRO. Nasdaq futures fall after Nvidia posts quarterly earnings August 28, kraeved48.ru S&P E-Mini Dow Jones Futures Contract Specifications ; Daily Price Limits, Daily price limits and trading halts of the CBOT DJIA Index ($5 Multiplier) futures. CME futures exchange: Mini Dow Jones Futures (symbol: YM) Contract Specifications - including trading hours and months. View live Micro E-mini Dow Jones Industrial Average Index Futures chart to track latest price changes. Trade ideas, forecasts and market news are at your.

Moneygram Without Id

Just had a customer come in to send money, but didn't have his actual ID on him. He wanted me to accept a picture of his ID on his phone. Visit any UBA Branch with valid means of identification: The only acceptable means of ID for MoneyGram is the Bank Verification Number. Yes, customers without. You must verify the consumer's identity by viewing a valid government issued photo identification that contains the person's. MoneyGram transfers. MoneyGram Transfer-Product Detail Your name on the transfer record must be an exact match to your name as it appears on your ID or. Hi, Fernando. While the name listed on your transfer must match the name listed on your ID exactly, please have your sender reach out to our Customer Service. Walmart will cash Western Union & MoneyGram money orders. Check cashing fees may apply. Do I need ID? For purchases over $1,, a valid government-issued. ID: You will need to bring a valid photo ID (passport, national ID or residence permit) and may also be asked to provide proof of your address (bank. How to send money · For all sends: Your I.D. where applicable; Your recipient's full name matching their I.D. and their location · If sending to a bank account. 1. Find a location Find a MoneyGram agent location near you. Complete the form 2. Complete the form, if applicable If required, complete a simple receive form. Just had a customer come in to send money, but didn't have his actual ID on him. He wanted me to accept a picture of his ID on his phone. Visit any UBA Branch with valid means of identification: The only acceptable means of ID for MoneyGram is the Bank Verification Number. Yes, customers without. You must verify the consumer's identity by viewing a valid government issued photo identification that contains the person's. MoneyGram transfers. MoneyGram Transfer-Product Detail Your name on the transfer record must be an exact match to your name as it appears on your ID or. Hi, Fernando. While the name listed on your transfer must match the name listed on your ID exactly, please have your sender reach out to our Customer Service. Walmart will cash Western Union & MoneyGram money orders. Check cashing fees may apply. Do I need ID? For purchases over $1,, a valid government-issued. ID: You will need to bring a valid photo ID (passport, national ID or residence permit) and may also be asked to provide proof of your address (bank. How to send money · For all sends: Your I.D. where applicable; Your recipient's full name matching their I.D. and their location · If sending to a bank account. 1. Find a location Find a MoneyGram agent location near you. Complete the form 2. Complete the form, if applicable If required, complete a simple receive form.

Head to your nearest participating branch. Pop into the nearest Post Office branch that offers MoneyGram with one of these forms of ID: passport, valid UK. The MoneyGram® app provides the speed, flexibility and freedom to move money on your terms. That's why we're now a proud partner of Haas F1 Team – our. MoneyGram – is an express funds transfer system between individuals without opening an account. ID document; Indicate the recipient's country, name and. identity · Purchase stamps and meters · Shop · Billing and Invoices. Articles and without shipping or transaction fees · Prepaid cards and services · Prepaid. Complete a simple Receive Form using the Reference Number and hand the form to the MoneyGram agent along with your government issued ID. You can buy, sell or store crypto through the MoneyGram app in all U.S. states (except AK, HI, ID, LA, NY, VT, US territories), and the District of Columbia. Important: Your name on the transfer record must exactly match your name as it appears on your ID. Otherwise, you may be delayed or be unable to pick up your. How to receive money · Government-issued identification (ID) that displays your legal name · Reference number - request the reference number from the person who. "Method 1" or "Method 2" documents are required to submit your identity verification documents and personal number. When uploading, please have your identity. Hand the receive form and your valid photo I.D. to the person at the counter to receive your money. Receive Transaction Tiers. Tier 1 ($1JMD – $,JMD) . We're here to help · How can I estimate fees before I start a money transfer? · Which countries can I send money to? · How do I track the status of a transfer? Does the receiver's name have to match their government issued ID exactly? What are the types of ID I can provide? expand_more. You can provide a. How to send money · Find a location · Prepare for your agent visit · Bring the following information: For all sends: Your I.D. where applicable; Your recipient's. Transfer limits. Methods of payment ; Western Union. Up to $3, without additional ID verification. Up to $50, upon verification. Credit or debit card, cash. Identity Theft · Seniors and the Elderly · Open You can make child support payments with a credit or debit card through the secure MoneyGram website. Verify your ID. Select the country and your language. Verify your ID. Select MoneyGram International Limited, 1st Floor Senator House, 85 Queen. Without Collateral Rocket Line Rocket loans/credit lines Credit Lines Profi ID document from the service center from which the transfer was effected. Or you can withdrawal cash at ACLEDA Bank's counter by showing the 8-digit reference number and attaching ID card without limitation. Receiving money with. ID. The person who sent you money should have the Reference Number. Some countries also require a valid proof of address when an ID does not contain an address. 1. Can I collect cash sent to me into my wallet without going to the bank? · 2. What do I need in order to convert my MoneyGram cash pick into my Zeepay mobile.

Mba Supply Chain Management Vs Mba Finance

Focus: This specialisation trains you to design, plan, and control the entire flow of business operations. You'll learn about supply chain management, logistics. Business Administration - Supply Chain Management Concentration, MBA. Program Finance (3); MBA - Strategic Management (3); MBA - Executive. This course focuses on the applications of forecasting models and methodologies throughout supply chains, for use in business related activities, including. The following courses or their equivalents are required of all degree candidates1. ACCTNG , Financial and Managerial Accounting, 3. FINANCE , Financial. The Graduate Programs Office reserves the right to request an applicant submit a WES or ECE evaluation. Documentation of Financial Support: After an admission. The Skills and Topics Covered in MBA Supply Chain Management Courses Include: · Legal aspects of supply chain management including state, federal, and. Students can earn an MBA or one of several master's degrees in supply chain management on-campus or online. MBA programs provide a broad business background. FINC Financial Management; MKTG Marketing Management or MKTG International Marketing; MGMT Operations and Supply Chain Management; MGMT. Course Descriptions. Part-Time MBA students may take electives, without taking Operations Analysis prior, at the discretion of the instructor or academic. Focus: This specialisation trains you to design, plan, and control the entire flow of business operations. You'll learn about supply chain management, logistics. Business Administration - Supply Chain Management Concentration, MBA. Program Finance (3); MBA - Strategic Management (3); MBA - Executive. This course focuses on the applications of forecasting models and methodologies throughout supply chains, for use in business related activities, including. The following courses or their equivalents are required of all degree candidates1. ACCTNG , Financial and Managerial Accounting, 3. FINANCE , Financial. The Graduate Programs Office reserves the right to request an applicant submit a WES or ECE evaluation. Documentation of Financial Support: After an admission. The Skills and Topics Covered in MBA Supply Chain Management Courses Include: · Legal aspects of supply chain management including state, federal, and. Students can earn an MBA or one of several master's degrees in supply chain management on-campus or online. MBA programs provide a broad business background. FINC Financial Management; MKTG Marketing Management or MKTG International Marketing; MGMT Operations and Supply Chain Management; MGMT. Course Descriptions. Part-Time MBA students may take electives, without taking Operations Analysis prior, at the discretion of the instructor or academic.

With a supply chain management MBA degree from IUP, you'll be set up to work in many industries, including consulting, finance, healthcare, pharmaceuticals. Applicants with non-business undergraduate degrees and/or applicants missing pre-requisite undergraduate courses may be required to take additional foundation. Earn a master's degree in business administration (MBA) with an emphasis in supply chain management from Lindenwood University in St. Louis (St. Charles). in business analytics, finance, healthcare administration, logistics and supply chain management, or earn a general master of business administration. Answer: According to PayScale, an individual with a Master of Business Administration in Finance earns more (on average) than someone with a Master of Business. By completing this form, I consent to Michigan Ross contacting me by email, telephone and/or SMS at the telephone number (if provided above) regarding. You may choose 7 of the following 8 core courses: MBA Managerial Accounting; MBA Corporate Financial Management; MBA IT Management and Innovation. Accounting Systems · Digital/Business Analytics · Entrepreneurship and Innovation · Finance · Financial Accounting · Global Supply Chain Management · Healthcare. In the supply chain management MBA program, you'll deepen your understanding of procurement, transportation planning, inventory control and warehouse management. director of distribution or global procurement;; VP of supply chain, transportation or supply management; and; chief supply chain officer. MBA Curriculum. MBA graduates in Supply Chain Management can opt for jobs in shipping, construction, transportation, retail, warehousing, oil and gas, raw material supply and. Admission is rolling, and you may begin the program in September or January. May admission is also usually possible for part-time students. University of. It is a professional degree geared towards general business and key business management practices. Topics include a wide array of subjects, such as statistics. Your training in the supply chain management program will make you a competitive candidate for increasingly important positions in organizations everywhere. finance, health services administration, marketing or operations and supply chain management Administration: Operations and Supply Chain Management (MBA). Advance your ability to assess the design and integration of complex systems within an organization, helping you to predict behavior and improve or optimize. In our online MBA Supply Chain Management specialization, students evaluate how to mitigate risk and implement operational strategies in global supply chains by. Supply Chain Management, Finance, Marketing, Management, Business Communications, and Accounting. The difference between the Traditional and STEM MBA. Obtain skills for leadership roles in SCM with the online Master of Business Administration (MBA) in Supply Chain Management at St. Cloud State University. management, finance and accounting, management and human resources, and risk management and insurance. You can also pursue one or more graduate-level.

How Much Is The Closing Cost For Refinancing

The average cost to refinance a mortgage is $2,, according to ClosingCorp. Factors that affect refinance closing costs. After applying for the refinance. The mortgage lender Freddie Mac suggests budgeting about $5, for closing costs, which include appraisal fees, credit report fees, title services, lender. Our mortgage refinance cost calculator helps you determine the cost to refinance your mortgage. Learn how much it costs to refinance with U.S. Bank. Finally, borrowers can elect to roll some or all of the closing costs when refinancing. And in most instances, borrowers do just that. On a $, loan, the. You'll typically pay mortgage refinance closing costs ranging from 2% to 6% of your loan amount, depending on the loan size. National average closing costs for. As we mentioned earlier, you are responsible for closing costs and other fees during a refinance, just like you were when you took out your first mortgage. It. How Much Does It Cost to Refinance a Mortgage? · Application fee: Some lenders might charge a loan application fee, perhaps around $, when you submit your. There really is no way to completely avoid closing costs during a mortgage refinance, however, there are some common ways to avoid paying them upfront. Looking to refinance? This refinance closing cost calculator helps you estimate your fees and costs so you'll have an idea of what you can expect to pay. The average cost to refinance a mortgage is $2,, according to ClosingCorp. Factors that affect refinance closing costs. After applying for the refinance. The mortgage lender Freddie Mac suggests budgeting about $5, for closing costs, which include appraisal fees, credit report fees, title services, lender. Our mortgage refinance cost calculator helps you determine the cost to refinance your mortgage. Learn how much it costs to refinance with U.S. Bank. Finally, borrowers can elect to roll some or all of the closing costs when refinancing. And in most instances, borrowers do just that. On a $, loan, the. You'll typically pay mortgage refinance closing costs ranging from 2% to 6% of your loan amount, depending on the loan size. National average closing costs for. As we mentioned earlier, you are responsible for closing costs and other fees during a refinance, just like you were when you took out your first mortgage. It. How Much Does It Cost to Refinance a Mortgage? · Application fee: Some lenders might charge a loan application fee, perhaps around $, when you submit your. There really is no way to completely avoid closing costs during a mortgage refinance, however, there are some common ways to avoid paying them upfront. Looking to refinance? This refinance closing cost calculator helps you estimate your fees and costs so you'll have an idea of what you can expect to pay.

Homeowners who don't have the money saved for closing costs can ask their mortgage lender to waive the closing costs—called a “no-closing-cost refinance.”. Can I roll in my closing costs when I refinance? Yes. Rolling closing costs into your new loan is known as a no-cost refinance and may be a good strategy if. Use our calculator to find out rates, fees, closing costs, and affordability. Compare with typical industry average closing costs. Refinancing your existing mortgage can be stressful, especially when you are unfamiliar with the steps/costs involved. Some Refinance Closing Costs are. Use this calculator to estimate how much it will cost you to refinance your home loan. The average closing costs on a refinance are approximately $5,, but the size of your loan and the state and county where you live will play big roles in how. Read on for some tips and tricks that will help you weigh the expense of closing costs against the benefits of a refinance. Closing costs typically equal about 1 to 4% of your loan amount. For example, if your loan amount is $,, your closing costs could range from $2, to. Can I roll in my closing costs when I refinance? Yes. Rolling closing costs into your new loan is known as a no-cost refinance and may be a good strategy if. How to Determine Your Refinancing Costs · Application Fee $ 75 to $ · Appraisal Fee $ to $ · Survey Costs $ to $ · Homeowners Hazard Insurance $ Common mortgage refinance fees ; Origination fee, Up to % of loan amount ; Credit report fee, $10 to $ per applicant ; Document preparation fee, $50 to $ Almost every home refinance comes with closing costs. These closing costs can average between 2% and 6% of the loan amount according to kraeved48.ru About half of your mortgage closing costs go to a third-party for necessary transaction services. In total, you may be looking at anywhere from zero dollars to. This refinance closing costs calculator provides a guide for how to calculate closing costs on a refinance. The average cost to refinance a mortgage in the United States typically ranges from 2% to 6% of your loan amount. On average, homeowners can expect to pay 2% to 3% of the loan amount to refinance a mortgage. Refinancing a $, home loan, for example, may cost $6, to. Closing costs can run from 1% to 4% of your home purchase price — and they're are on top of your down payment. Calculate yours to avoid 'mortgage-close shock'. Typical closing costs, the amount you pay when you finalize the loan, will range from $ to $, but every transaction is different. The costs of a. Closing costs for a mortgage refinance can vary greatly - often between 2% and 5% of the purchase price. Here's how to better expect costs around. This tool calculates your mortgage refinance closing costs for a given set of loan terms.

1 2 3 4